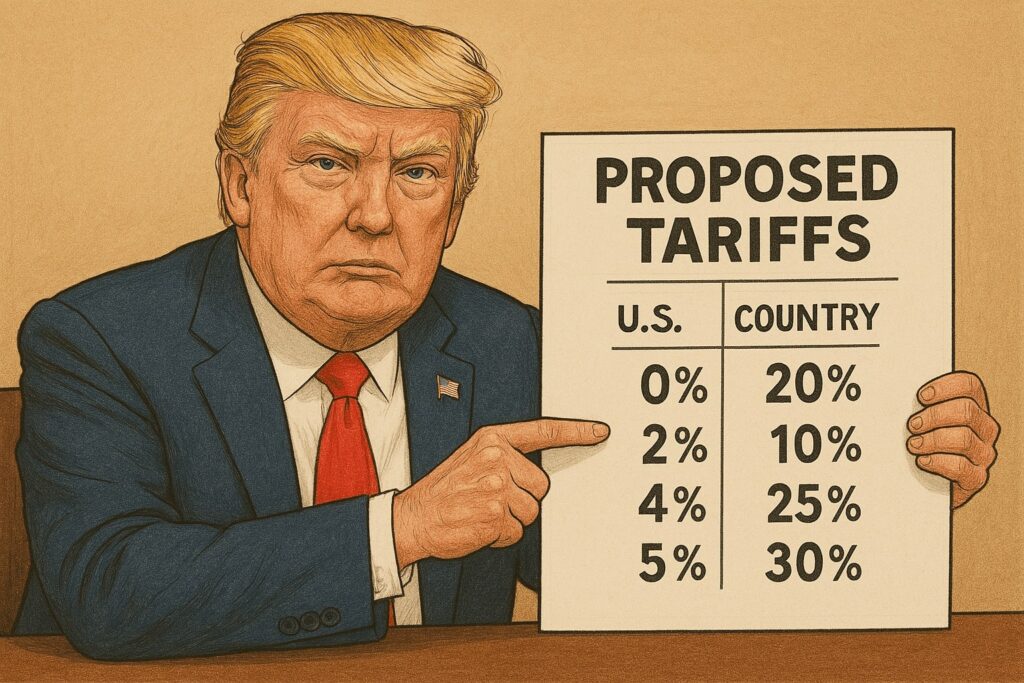

In 2025, President Trump introduced new tariffs on various imported goods, continuing a trade policy that emphasizes American manufacturing and job protection. These Trump Tariffs 2025 are designed to reduce trade deficits and encourage local production by imposing higher costs on imports. This article will explore the details of these tariffs, their immediate and long-term economic impacts, and the global response.

Key Takeaways

- The Trump Tariffs of 2025 impose an average effective tariff rate of 23% on imports, significantly increasing costs for various goods and impacting supply chains and consumer prices.

- Industries such as technology and automotive face heightened operational costs and potential production delays, which could lead to long-term shifts in supply chain strategies and sourcing practices.

- The international response includes varied strategies from countries like China and the EU, with potential impacts on global trade relations and future negotiations as tariffs influence economic stability and trade dynamics.

Table of Contents

- Overview of Trump Tariffs 2025

- Immediate Economic Impacts

- Sector-Specific Effects

- International Response and Trade Negotiations

- Global Trade Effects

- Long-Term Economic Projections

- National Interest

- Strategies for Businesses

- Case Studies

- Government Bonds and Investment

- Summary

- Frequently Asked Questions

- Your Partner in a Changing Market

Overview of Trump Tariffs 2025

In 2025, President Trump enacted a series of tariffs aimed at a broad range of imported goods, including steel, aluminum, and various consumer products. These tariffs mark a continuation of the administration’s trade policy, which prioritizes American products and jobs. The primary objectives are to reduce trade deficits, encourage local manufacturing, and protect domestic jobs.

These tariffs are part of president trump’s tariffs broader strategy to create a level playing field for American manufacturers by imposing higher tariffs on imports. This approach is intended to incentivize domestic production and reduce dependence on foreign goods.

The specific tariff rates, executive order details, and immediate and long-term economic impacts will be examined.

The most notable change in tariff rates is the 145% average effective tariff rate on imported goods from China. Additionally, low-value packages from China now face a 120% tariff. South Korean imports are not exempt either, with a 25% tariff imposed on them in 2025. Overall, the average effective tariff rate in the U.S. has surged to approximately 23%, a significant increase from previous years.

These higher rates are part of a strategic move to leverage tariffs in trade negotiations, aiming for reciprocal tariffs with trading partners. This aggressive tariff policy reflects a significant shift in the U.S. approach to international tariff negotiations.

The impact of these tariffs is far-reaching, influencing not just the cost of imported goods but also the dynamics of global trade relations.

President Trump signed an executive order on April 2, 2025, which introduced a minimum 10% tariff on all U.S. imports, effective from April 5. This executive order is part of a broader strategy to apply pressure on trading partners to negotiate more favorable trade agreements. If trade agreements are not established within a designated pause period, tariffs will revert to higher levels.

Industries reliant on imported materials, like automobiles and parts, may face increased production costs and supply chain disruptions due to the executive order. This strategy seeks to protect domestic manufacturing and ensure economic security by prioritizing American-made products, including certain critical minerals.

Immediate Economic Impacts

The introduction of these tariffs has had immediate economic impacts across various sectors. Supply chain disruptions and increased costs are common consequences, particularly for industries heavily reliant on imported materials. Economists predict significant upward pressure on consumer prices, which will likely affect household budgets and overall economic growth.

The stock market’s reaction, changes in consumer prices, and increased business costs resulting from these tariffs will be examined further.

The stock market reacted swiftly and with volatility to the tariff announcement. The Dow Jones Industrial Average dropped 1,600 points on April 10, 2025, reflecting investor concerns about economic stability. However, the stock market experienced a sharp rise shortly after, recovering from four days of prior declines.

In Europe, the Stoxx 600 index rose by 7.25%, highlighting the global impact of these tariffs. This unusual volatility, where both stocks and U.S. Treasuries declined simultaneously, underscores the uncertainty introduced by the new tariffs and their potential long-term consequences on financial markets.

The stock market reacted swiftly and with volatility to the tariff announcement. The Dow Jones Industrial Average dropped 1,600 points on April 10, 2025, reflecting investor concerns about economic stability. However, the stock market experienced a sharp rise shortly after, recovering from four days of prior declines.

In Europe, the Stoxx 600 index rose by 7.25%, highlighting the global impact of these tariffs. This unusual volatility, where both stocks and U.S. Treasuries declined simultaneously, underscores the uncertainty introduced by the new tariffs and their potential long-term consequences on financial markets.

Tariffs have already led to increased prices for everyday goods, affecting consumers. The consumer price index is projected to peak around 4% in 2025, significantly higher than the Federal Reserve’s long-term target. This increase is particularly pronounced in sectors like technology and automotive, where the cost of imported components has risen sharply.

Major tech firms face increased costs due to tariffs on electronic components, potentially leading to higher consumer prices and hindering innovation. The automotive market also faces rising prices and potential production delays due to tariffs affecting parts supply. Retailers are expected to pass on these increased costs to consumers, resulting in higher prices for various goods.

Lower-income households are expected to see a greater percentage reduction in disposable income due to tariffs compared to wealthier households. The lifetime financial burden on middle-income families due to tariffs is estimated to be around $58,000. These impacts highlight the broader economic implications of the tariffs on everyday consumers.

Rising operational costs due to increased tariffs on imported goods are challenging businesses. Many companies are reassessing their pricing strategies and profit margins as they consider whether to raise prices. The technology industry, in particular, faces significant pressures as many components are sourced internationally, impacting product pricing and availability.

Companies may alter their supply chains to cope, potentially decreasing imports by $6.9 trillion over the next decade. Amazon sellers are anxious as rising tariffs on Chinese imports affect their pricing strategies and business models.

Sector-Specific Effects

The effects of the tariffs are felt differently across various sectors. While some industries are struggling with increased costs and supply chain disruptions, others are finding ways to adapt.

The specific impacts on the technology sector, automotive industry, and retail and wholesale sectors will be explored, detailing how these industries navigate the new tariff landscape.

The technology sector has been significantly impacted by the Trump tariffs of 2025. Major technology companies like Tesla and Nvidia experienced drops in their stock prices following the announcement of the tariffs. Prior to this decline, the Nasdaq Composite had experienced its best day since 2001, showcasing the volatility in tech stocks.

These tariffs may lead to long-term changes in supply chains and sourcing strategies within the technology sector. Companies are likely to reconfigure their global supply chains, potentially moving production closer to consumer markets to mitigate the effects of the tariffs.

The automotive industry is also feeling the strain of increased tariffs on imported automobile parts. U.S. manufacturers are facing price hikes on essential parts, leading to increased vehicle prices for consumers. The overall automotive market is experiencing a slowdown in growth as manufacturers adjust to higher costs and tariffs.

Long-term changes in the automotive supply chain and production strategies are expected if tariffs remain in place. Manufacturers may need to relocate production or source parts from alternative suppliers to maintain competitive pricing and avoid significant production delays.

Tariffs are impacting the cost of imported goods, prompting retailers and wholesale suppliers to adjust their pricing strategies. The imposition of tariffs may compel wholesalers to seek alternative suppliers to mitigate cost increases, affecting long-term supplier relationships.

In the retail and wholesale sectors, tariffs are influencing both pricing and supply chain decisions. Retailers are likely to pass on increased costs to consumers, leading to higher prices for various goods sold in stores.

International Response and Trade Negotiations

The international response to the Trump tariffs of 2025 has been varied, with different countries adopting different strategies to cope with the new trade policies. While some countries have lodged formal complaints, others are seeking to negotiate favorable trade terms.

The responses from the European Union, China, and other countries will be examined, highlighting the global implications of these tariffs.

The European Union is advocating for more balanced trade practices and has expressed concerns about the negative impact of the tariffs on its economy. European Commission President Ursula von der Leyen emphasized the need for clear and stable trading conditions to ensure fair trade practices.

The EU has temporarily halted retaliatory tariffs against the U.S. to allow for further discussions. This move reflects the EU’s desire to negotiate a more balanced trade agreement that benefits both sides.

China has responded to the U.S. tariffs by implementing tariffs as high as 84% on American imports. These countermeasures are part of China’s strategy to protect its own economy and retaliate against the perceived unfair trade practices of the U.S.

China has also lodged formal complaints against the U.S. at the World Trade Organization, highlighting escalating trade tensions. These actions underscore the broader implications of the tariffs on global trade relations.

Other countries, like South Korea, are focusing on securing favorable trade terms to avoid negative impacts from U.S. tariff policies. South Korea aims to renegotiate existing U.S. tariff levels during ongoing discussions.

Meanwhile, ASEAN has collectively decided against retaliatory measures, reflecting a varied global response to the tariffs. ASEAN members are collaborating to adjust their trade policies amid the changing tariff environment.

Global Trade Effects

The imposition of tariffs by President Trump has significantly impacted international trade dynamics, leading to a shift in global trade alliances and patterns. The reciprocal tariffs imposed by the US and other countries, such as China, have resulted in a decline in international trade, with many countries seeking alternative trading partners. The European Union, for example, has been actively engaged in tariff negotiations with the US, seeking to reduce the impact of tariffs on its member states. Meanwhile, countries like South Korea have been exploring new trade agreements with other nations to mitigate the effects of tariffs.

The tariffs have created a ripple effect across global markets, prompting countries to reassess their trade strategies. For instance, the European Union has been negotiating to secure more favorable terms and avoid the economic strain caused by higher tariffs. Similarly, South Korea is actively seeking new trade deals to diversify its economic partnerships and reduce dependency on the US market. These efforts highlight the broader impact of the tariffs on international trade dynamics, as countries adapt to the new economic landscape.

The tariffs imposed by President Trump have led to a significant shift in global trade alliances, with many countries re-evaluating their trade relationships with the US. The US has been seeking to renegotiate existing trade agreements, such as NAFTA, and has imposed tariffs on certain critical minerals, leading to tensions with trading partners like China. In response, China has been seeking to diversify its trade relationships, increasing its trade with other countries, such as those in the European Union. This shift in global trade alliances is likely to have a lasting impact on the global economy, with many countries seeking to reduce their dependence on the US market.

As countries like China and the European Union adjust their trade strategies, the global economy is witnessing a realignment of trade partnerships. China’s efforts to diversify its trade relationships are evident in its increased engagement with European markets, aiming to mitigate the impact of US tariffs. This strategic shift is reshaping global trade alliances, as countries seek to establish more balanced and resilient economic ties. The long-term implications of these changes are profound, potentially leading to a more multipolar global trade system where reliance on any single market is minimized.

The long-term economic impacts of the Trump tariffs of 2025 are projected to be significant. These tariffs are expected to reshape global trade flows, potentially decreasing U.S. GDP and leading to shifts in supply chains and wage growth.

GDP impact projections, supply chain shifts, and the effects on inflation and wages will be examined.

Economic models indicate that the introduction of tariffs could decrease U.S. GDP by approximately 8% over the long term. This significant decline reflects concerns among economists about a potential recession in both the U.S. and global economies.

U.S. wages may drop by around 7% due to the tariffs, according to forecasts. These projections underscore the broader economic implications of the tariffs on overall economic growth and stability in the U.S. economy.

As global trade dynamics shift due to new tariffs, companies are expected to adapt by relocating their supply chains closer to domestic markets. This shift is likely to decrease imports and promote a more localized approach to production and distribution.

Companies may reconfigure their supply chains, potentially moving production closer to consumer markets to mitigate tariff effects. This shift could lead to a significant reorganization of global supply chains and trade relationships.

The imposition of tariffs is expected to lead to a significant increase in consumer prices, contributing to higher inflation rates. This rise in prices will likely impact wage growth over time, as businesses impose their pricing strategies and profit margins to cope with increased costs.

Retailers are already experiencing price increases on imported goods due to tariffs, which may lead to higher consumer prices and altered purchasing decisions. Around 30% of firms in the retail and wholesale sector anticipate hiring declines due to tariff-related uncertainty, further impacting wage growth and employment.

National Interest

The tariff policy implemented by President Trump is aimed at aligning with US economic goals, particularly in terms of promoting economic security and fair trade. The tariffs are designed to protect American businesses and industries, such as the lumber and automobile parts sectors, from unfair competition from other countries. The administration has also been seeking to reduce the trade deficit, which it believes is a threat to national security. However, the impact of tariffs on the US economy has been mixed, with some sectors, such as the steel industry, benefiting from the tariffs, while others, such as the retail sector, have been negatively affected. Overall, the tariff policy has been a key component of the administration’s trade policy, aimed at promoting American economic interests and protecting national security.

The administration’s focus on economic security is evident in its efforts to shield key industries from foreign competition. By imposing tariffs on imported goods, the policy aims to create a more level playing field for American manufacturers. However, the mixed impact on different sectors highlights the complexity of the tariff policy. While industries like steel have seen a boost, others, particularly those reliant on imported goods, face increased costs and supply chain disruptions. This dual impact underscores the challenges of balancing protectionist measures with broader economic stability.

Strategies for Businesses

Businesses are facing unprecedented challenges due to the new tariffs, but there are strategies they can employ to navigate this complex landscape. From sourcing alternatives to cost management and customer communication, businesses must adapt to maintain profitability and customer loyalty.

Practical strategies that businesses can adopt to thrive in the current economic environment will be explored.

Companies may adjust their global supply chains to mitigate tariff impacts, potentially reallocating sourcing strategies. This may involve shifting to countries with lower or no tariff barriers, implementing cost-effective practices like bulk purchasing, and regularly reviewing supplier contracts to uncover opportunities for better pricing or terms.

Adapting sourcing and management strategies is essential for businesses to effectively mitigate tariff impacts. By exploring new supplier relationships and diversifying their sourcing base, businesses can find ways to reduce costs and maintain competitive pricing.

Tariffs have pressured businesses to adapt their cost management strategies amidst rising expenses. To cope with increased import costs, many companies pay reassessing their pricing strategies and adjusting them accordingly.

Businesses are increasingly looking for alternative suppliers or local production options to mitigate the impacts of tariffs. Proactive financial planning and cost-control measures are crucial for businesses to navigate the tariff landscape successfully.

Utilizing multiple communication channels can enhance the effectiveness of conveying important updates to customers. Transparency about cost increases fosters trust and encourages customer loyalty. Effective communication is vital for conveying price changes and delays to customers.

Implementing clear and honest communication practices will help businesses maintain customer engagement during price adjustments.

Avoid the Top 5 Mistakes Wholesale Distributors Make

Are you making one of the top 5 mistakes that plague wholesale distributors? Download our free eBook to find out. We’ve also included tips and guidance to help you save time and avoid costly mistakes.

Case Studies

Understanding how different companies navigate tariff challenges is crucial for assessing the wider economic impact. Case studies of Amazon sellers, manufacturers shifting production, and small businesses adapting to increased costs will illustrate how various businesses are responding to the new tariffs.

Amazon selling sellers are exploring markets outside the U.S., such as Canada, Mexico, and the U.K., in response to tariffs. Some are considering sourcing products from U.S. manufacturers to avoid tariffs altogether.

Amazon sellers are adapting their business models to navigate tariff challenges. This includes diversifying their supplier base and adjusting pricing strategies to remain competitive in the global market.

Tariffs imposed in 2025 have prompted manufacturers to purchase additional duties shift their production overseas to maintain competitive pricing and meet demand. For example, several electronics manufacturers relocated production facilities from China to Southeast Asia.

These relocations have significantly reconfigured the global economy supply chains, impacting logistics and cost structures. In the long term, this trend may lead to a diversification of global manufacturing hubs, reducing reliance on any single country.

Smaller businesses are facing challenges in absorbing the increased costs from tariffs since they often have limited options to pass these costs onto consumers. Many small enterprises are implementing small, incremental price increases rather than large adjustments to cope with rising costs due to tariffs.

The creative adaptations made by small businesses in response to tariff challenges may lead to more resilient and flexible operations in the future. Diversifying their supplier base to reduce reliance on single countries affected by tariffs is another strategy being employed.

Government Bonds and Investment

The impact of tariffs on government bonds and investment trends has been profound. Escalating tariffs have led to significant sell-offs in the bond market, indicating a decline in investor confidence in U.S. financial stability and affecting bond prices.

Volatility in the bond market and shifting investment strategies in response to new trade policies will be explored.

Yields on U.S. Treasury bonds have seen their largest intraday fluctuations since Trump’s presidency, reflecting heightened market anxiety. This unprecedented volatility is largely attributed to uncertainty surrounding the economic impacts of the tariff announcements.

Investors are shifting towards longer-duration, fixed-rate securities in response to the uncertain economic environment caused by tariffs. As the bond market adjusts to new economic realities imposed by tariffs, investor strategies are likely to focus on safer securities.

In response to tariff fears, investors are shifting their portfolios away from traditional safe havens like U.S. Treasuries, seeking alternative investment opportunities. This strategic shift highlights how trade policies are influencing investor behavior and asset allocation across the market.

Investors are reallocating assets towards sectors likely to benefit from new trade policies, moving away from previously favored investments. In response to the 2025 tariffs, investors are making significant changes to their portfolios to mitigate risks associated with trade policies.

Summary

The Trump tariffs of 2025 have had far-reaching impacts on the global economy and trade dynamics. From immediate economic consequences to long-term projections, these tariffs are reshaping supply chains, influencing consumer prices, and altering investment strategies. As businesses and countries navigate this new landscape, the strategies employed will determine their ability to thrive in a rapidly changing economic environment. The key to success lies in adaptability, strategic planning, and transparent communication. The road ahead is challenging, but with the right approach, it is possible to turn these challenges into opportunities for growth and innovation.

Frequently Asked Questions

The key objectives of the Trump tariffs of 2025 are to reduce trade deficits, promote local manufacturing, and safeguard domestic employment through increased tariffs on imports.

Consumer prices have risen due to tariffs, with projections indicating a peak in the consumer price index around 4% by 2025, ultimately affecting households significantly.

Businesses are effectively adjusting their sourcing strategies, exploring alternative suppliers, and implementing cost management measures to cope with increased tariffs, while also maintaining transparent communication with customers regarding price adjustments.

The tariffs have caused significant volatility in the stock market, exemplified by a notable drop of 1,600 points in the Dow Jones Industrial Average, while simultaneously contributing to a 7.25% increase in the Stoxx 600 index in Europe. This indicates a complex reaction to trade policies affecting investor confidence.

Long-term economic projections suggest that tariffs may lead to a decrease in U.S. GDP by around 8%, negatively affecting wage growth and overall economic stability. This outcome highlights the potential risks associated with tariff implementation.

Your Partner in a Changing Market

As Trump tariffs reshape the global trade landscape, staying informed is more critical than ever. Orders in Seconds supports wholesale distributors not just with powerful mobile solutions, but by keeping you updated on the trends impacting your business.

Need help navigating supply chain shifts with better tools? Get in touch to learn how our apps can strengthen your operations.