Days Sales in Inventory (DSI) measures how quickly a company sells its inventory. Understanding DSI helps improve inventory management and cash flow. In this article, you’ll learn how to calculate DSI and why it matters.

Key Takeaways

- Days Sales in Inventory (DSI) measures the average time it takes for a company to sell its entire inventory, providing insights into inventory management efficiency.

- A DSI value between 30 to 60 days is generally considered optimal, though this can vary by industry; high DSI indicates potential overstocking, while low DSI may suggest stockouts.

- Optimizing DSI involves accurate demand forecasting, efficient inventory management practices, and utilizing technology such as inventory management software for real-time tracking and analysis.

Table of Contents

- Understanding Days Sales in Inventory (DSI)

- The Formula for Calculating DSI

- Step-by-Step Calculation Example

- Interpreting Your DSI Ratio

- Industry Benchmarks for DSI

- Inventory Turnover Ratio: A Related Metric

- Factors Affecting DSI

- Best Practices for Optimizing Inventory Management DSI

- Leveraging Technology for Better DSI Management

- Managing Working Capital with DSI

- Operational Efficiency and DSI

- Common Mistakes to Avoid in DSI Calculation

- Summary

- Frequently Asked Questions

- Streamline Inventory Operations to Support Better DSI Management

Understanding Days Sales in Inventory (DSI)

Days Sales in Inventory (DSI) fundamentally measures how long, on average, it takes for a company to sell its entire inventory. This metric provides insight into inventory management efficiency. This metric is calculated by dividing the average inventory by the cost of goods sold (COGS) and then multiplying by 365, which reflects the days inventory outstanding. The result is the number of days between the receipt of inventory and revenue from its sale.

Understanding DSI is vital for effective inventory management since it reflects a company’s inventory management efficiency and affects cash flow. A lower DSI suggests efficient inventory turnover, meaning the company can convert inventory into sales quickly. Conversely, a high DSI may indicate overstocking or slow-moving inventory, which can tie up capital and increase storage costs.

To accurately forecast inventory needs, it is essential to account historical sales data, which helps in predicting future customer demand and optimizing stock levels.

One of the significant benefits of tracking DSI is its ability to highlight inefficiencies in your inventory management practices. Regular monitoring of this metric enables companies to make informed decisions about purchasing, production, and sales strategies, ultimately improving cash flows and reducing costs. For businesses across various sectors, maintaining an optimal DSI is a balancing act that requires careful planning and execution.

Moreover, DSI can reveal whether a business is carrying too much or too little stock, which directly affects its ability to meet customer demand. Efficient inventory management ensures that companies have enough stock to satisfy customers without overcommitting resources to excess inventory. This delicate balance is key to maintaining a healthy cash flow and operational efficiency.

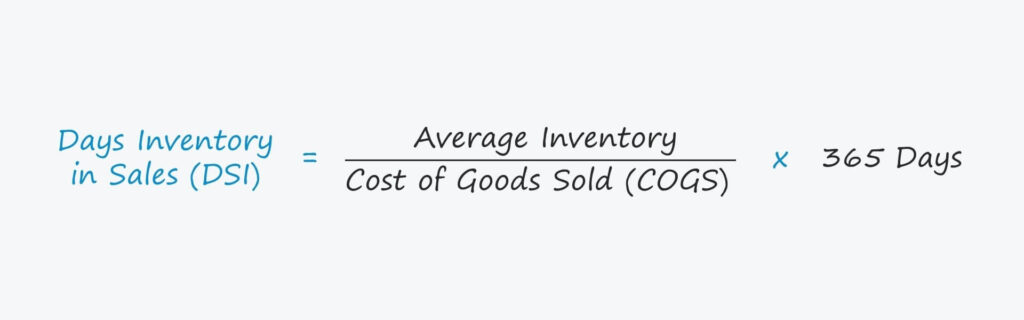

The Formula for Calculating DSI

Calculating Days Sales in Inventory (DSI) involves a straightforward formula that provides deep insights into your inventory performance. The formula is:

Days Sales in Inventory (DSI) = [ Average Inventory / Cost of Goods Sold (COGS) ] x [Number of Days]

Average inventory is computed by adding the beginning and ending inventory for a specific period and dividing that sum by two. To calculate average inventory, if your beginning inventory is $8 million and your ending inventory is $12 million, your inventory value would be $10 million. COGS includes all direct costs associated with producing or procuring the goods sold by your business.

It’s important to consider the time frame over which inventory is measured, typically a year or a financial quarter. This ensures that the DSI value accurately reflects your inventory performance over a consistent period.

By applying this formula, businesses can gain a clearer understanding of how long it takes to sell their inventory and make necessary adjustments to improve efficiency.

Step-by-Step Calculation Example

To illustrate how to calculate DSI, let’s walk through a detailed example. Suppose a company has a beginning inventory of $8 million and an ending inventory of $12 million. The average inventory can be calculated as follows:

Average Inventory Formula = [ Beginning Inventory + Ending Inventory] / 2

Average Inventory Example = [ $8 million + $12 million ] / 2 = $10 million

Next, let’s say the company’s Cost of Goods Sold (COGS) for the year amounts to $80 million. We can use the DSI formula to calculate Days Sales in Inventory. This allows us to determine how long inventory is held before it’s sold.

Days Sales in Inventory (DSI) = [ $10 million / $80 million ] x 365 = Approx. 46 days

This calculation shows that, on average, the company takes 46 inventory days to sell its inventory. This example underscores the importance of accurate inventory tracking and financial data for deriving meaningful insights from DSI calculations and to calculate inventory turnover and inventory calculation.

Interpreting Your DSI Ratio

Interpreting the DSI ratio is essential for grasping your company’s inventory efficiency. A good DSI range is generally considered to be between 30 to 60 days, though this can vary significantly by industry. For example, retail companies might have different DSI benchmarks compared to manufacturing firms due to differences in inventory turnover rates and sales cycles.

A high DSI value can indicate challenges in selling inventory, which may stem from mismanagement or difficulties in meeting market demand. High DSI values often lead to poor sales performance, excess inventory, and increased storage costs. This scenario can negatively impact a company’s cash flow, tying up capital that could be used more effectively elsewhere.

On the flip side, a very low DSI may suggest insufficient inventory levels, potentially leading to unmet customer demand and lost sales opportunities. Efficient inventory selling and quick cash conversion are indicated by low DSI values, which are associated with quicker inventory turnover and improved financial health. Therefore, achieving an optimal DSI is about balancing inventory levels to ensure neither overstocking nor stockouts.

To get a comprehensive view of your inventory performance, comparing your DSI against industry benchmarks and similar companies within the same sector is necessary. This context aids in assessing whether your DSI is within an acceptable range and identifying areas for improvement.

Industry benchmarks for Days Sales in Inventory (DSI) vary widely depending on the industry, company size, and other factors. However, here are some general guidelines on what constitutes a good DSI ratio:

For retail companies, a DSI ratio of 30-60 days is considered good.

For manufacturing companies, a DSI ratio of 60-120 days is considered good.

For wholesale companies, a DSI ratio of 30-90 days is considered good.

It’s essential to note that these are general guidelines, and the ideal DSI ratio for a company depends on its specific industry, business model, and operational efficiency. Understanding these benchmarks can help businesses set realistic targets for their days sales in inventory and make informed decisions to optimize their inventory management practices.

Inventory Turnover Ratio: A Related Metric

The inventory turnover ratio is a related metric to DSI that measures the number of times a company sells and replaces its inventory within a given period. Inventory turnover is calculated by dividing the cost of goods sold (COGS) by the average inventory value.

Inventory Turnover Ratio Formula = COGS / Average Inventory

Inventory Turnover Ratio Example = 80 million / 10 million = 8

A higher inventory turnover ratio indicates that a company is selling and replacing its inventory more quickly, which can be beneficial for cash flow and reducing storage costs. However, a very high inventory turnover ratio can also indicate that a company is not holding enough inventory to meet customer demand. Balancing inventory turnover with days sales in inventory (DSI) is crucial for maintaining efficient inventory management and ensuring that customer needs are met without overstocking or stockouts.

Factors Affecting DSI

Several factors can influence a company’s Days Sales in Inventory (DSI), causing it to fluctuate. The industry type is a significant determinant, as different sectors have varying standards for inventory turnover. For instance, companies dealing with perishable goods will naturally aim for a lower DSI compared to those selling durable goods.

Seasonality also significantly impacts DSI. Businesses often experience predictable spikes in sales during certain times of the year, which can impact inventory turnover rates. For example, retail companies might see higher sales during the holiday season, temporarily reducing their DSI.

Market demand is another significant factor. Sudden changes in consumer preferences or economic conditions can lead to overstocking or stockouts, affecting your DSI. Additionally, the product lifecycle impacts DSI reliability; new products may exhibit unpredictable sales patterns until demand stabilizes. Understanding these factors helps businesses better manage their inventory and optimize their DSI.

Best Practices for Optimizing Inventory Management DSI

Optimizing Days Sales in Inventory (DSI) requires a combination of accurate demand forecasting, efficient inventory management practices, and strategic use of technology. Accurate demand forecasting requires analyzing historical sales data and market trends to determine stock levels. It is crucial to account historical sales data as a critical factor in inventory forecasting. For instance, a pharmaceutical distributor improved its service level from 80% to over 95% while reducing excess inventory by 40% through enhanced demand forecasting and inventory optimization strategies.

Inventory planning software can streamline purchasing and maintain optimal stock levels based on demand. These tools provide real-time inventory tracking, allowing businesses to make data-driven decisions to optimize DSI. Setting precise inventory replenishment points prevents excess stock or stockouts, ensuring a balanced inventory.

Distributing inventory across multiple fulfillment centers can prevent stock obsolescence and reduce DSI. This approach also mitigates risks associated with supply chain disruptions and ensures timely replenishment. Practices like real-time tracking and accurate forecasting are essential for minimizing holding costs and maintaining efficient inventory levels.

Leveraging Technology for Better DSI Management

In today’s digital age, using technology is indispensable for optimizing Days Sales in Inventory (DSI). Inventory planning software optimizes purchasing, aligns stock levels with demand, reduces excess inventory, and improves turnover. For example, OIS Inventory management software provides real-time inventory data and analytics, helping businesses streamline their inventory control processes.

Inventory management software automates order placement and provides real-time inventory tracking, which is crucial for making informed decisions. The analytics dashboard from OIS Inventory helps users track critical metrics such as inventory turnover and average inventory valuation. These tools enable companies to maintain an optimal inventory balance, reducing the risks of overstocking or stockouts.

Advanced technologies like machine learning forecasting engines reduce forecast errors by 25%, facilitating better inventory management. Digital twin simulations also allow distributors to assess and adjust inventory requirements effectively to maintain service levels. Embracing these technological advancements can significantly improve your DSI and overall operational efficiency.

Managing Working Capital with DSI

Days Sales in Inventory (DSI) is a critical metric for managing working capital. A lower DSI ratio indicates that a company is converting its inventory into sales more quickly, which can help reduce storage costs, free up cash flow, and improve overall working capital management.

To manage working capital effectively, companies should aim to maintain a low DSI ratio by:

Optimizing inventory levels to meet customer demand

Implementing efficient inventory management practices

Reducing storage costs by minimizing inventory holding periods

Improving cash flow by converting inventory into sales more quickly

Efficient inventory management practices, such as accurate demand forecasting and real-time inventory tracking, can significantly impact a company’s ability to maintain a low DSI and enhance its financial health.

Operational Efficiency and DSI

Operational efficiency is critical for maintaining a low Days Sales in Inventory (DSI) ratio. Companies can improve operational efficiency by:

Streamlining supply chain processes to reduce lead times

Implementing just-in-time inventory management to minimize inventory holding periods

Optimizing inventory levels to meet customer demand

Improving demand forecasting to reduce inventory overstocking

By improving operational efficiency, companies can reduce their DSI ratio, free up cash flow, and improve overall working capital management. Efficient inventory management practices ensure that businesses can meet customer demand promptly while minimizing excess inventory and associated storage costs.

Avoid the Top 5 Mistakes Wholesale Distributors Make

Are you making one of the top 5 mistakes that plague wholesale distributors? Download our free eBook to find out. We’ve also included tips and guidance to help you save time and avoid costly mistakes.

Common Mistakes to Avoid in DSI Calculation

When calculating Days Sales in Inventory (DSI), companies should avoid the following common mistakes:

Using incorrect or outdated inventory values

Failing to account for seasonal fluctuations in inventory levels

Not considering the impact of inventory turnover on DSI

Using an incorrect time period for calculating DSI

Not adjusting for changes in inventory management practices or supply chain processes

By avoiding these common mistakes, companies can ensure that their DSI calculation is accurate and reliable, providing valuable insights into their inventory management practices and operational efficiency. Accurate DSI metrics are essential for making informed decisions that enhance inventory turnover and overall business performance.

Summary

In summary, understanding and optimizing Days Sales in Inventory (DSI) is crucial for efficient inventory management and improved financial health. By calculating DSI accurately and interpreting the results in the context of your industry, you can make informed decisions to enhance your inventory performance. Implementing best practices such as accurate demand forecasting, utilizing inventory planning software, and distributing inventory across multiple centers can significantly improve your DSI.

As you embark on this journey to optimize your DSI, remember that continuous monitoring and adjustment are key to maintaining an efficient inventory system. By leveraging the strategies and technologies discussed in this guide, you can achieve a lower DSI, better meet customer demand, and improve your company’s overall operational efficiency.

Frequently Asked Questions

Days Sales in Inventory (DSI) is a metric that indicates the average number of days a company requires to sell its inventory, thereby serving as a gauge of inventory management efficiency and cash flow.

DSI is calculated using the formula: [ Average Inventory / Cost of Goods Sold (COGS) ] x 365. This formula provides insight into the average number of days inventory is held before it is sold.

DSI varies across industries because of differing inventory turnover rates, product lifecycles, and seasonal sales patterns. These factors significantly influence how businesses manage their inventory and cash flow.

A low DSI signifies quicker inventory turnover, enhancing cash flow and inventory management. This efficiency minimizes the risks of overstocking and stockouts.

Technology can optimize Days Sales of Inventory (DSI) by utilizing inventory management software and machine learning forecasting tools, which enhance real-time tracking, offer accurate demand predictions, and automate order placements. This leads to more efficient inventory management and reduced holding costs.

Streamline Inventory Operations to Support Better DSI Management

Optimizing Days Sales in Inventory (DSI) is key to efficient inventory turnover and healthy cash flow. While tracking DSI offers valuable insights, tools like the OIS Inventory app can support your broader inventory management efforts. By simplifying order picking, reducing errors, and improving operational accuracy, OIS Inventory helps create a seamless order fulfillment process, ensuring your inventory moves efficiently through the supply chain.

Empower your team to manage stock smarter and achieve peak inventory performance with OIS Inventory. Start building better processes today.